UPDATE MARCH 2022: CHECK THE NEW OFFER WITH 20,000 BONUS MILES!

Brussels Airlines American Express has a limited time offer: double sign-up bonus for friend referrals. To receive a personalized sign-up link for this offer, please complete the form below.

- Classic American Express card (€60 per year)

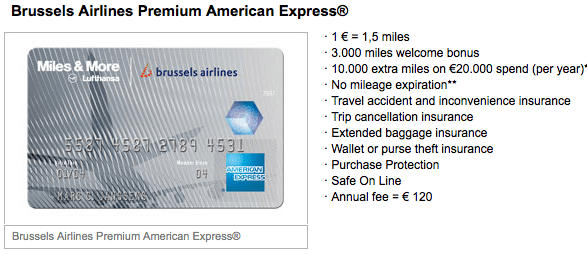

Sign-up bonus: 3000 miles (normally 1500) - Premium American Express card (€120 per year)

Sign-up bonus: 6000 miles (normally 3000) - Pay your cellphone bill with American Express

Extra bonus: 2000 miles (one time)

Earning airline miles is not limited to flying, you can earn miles with almost anything these days. One of the easiest ways to earn extra miles is signing up for a credit card. You will receive a number of miles just for signing up for the card and you will get 1 or 1,5 miles per euro spent. American Express also provides a bonus when you spend a certain amount in one year. Unfortunately, the number of credit cards earning airline miles is very limited in Belgium. Still, they can offer you a great opportunity to travel the world in luxury on a budget. For Belgian citizens, the credit card offers are limited to one program, Miles and More of the Lufthansa group. Miles of this program can be used to book (and upgrade) flights on any Star Alliance carrier.

Brussels Airlines offers four Miles and More credit cards: the Classic MasterCard, Premium MasterCard, Classic American Express and Premium American Express. I signed-up for the Brussels Airlines Classic American Express Card in 2008 and switched to the Premium Amex card last year earning me a total of more than 100,000 miles! The key to earning the maximum amount of miles is to pay as much as possible with your credit card. Pay all your bills and purchases (both online and offline) with your credit card, every euro counts! Shopping (including groceries), dining, gas, electronics, hotels, airline tickets, … almost everything! Some payments might even result in an extra bonus. Example: Paying your cellphone bill with your Brussels Airlines American Express card gets you 2000 bonus miles!

The yearly fee also contains a number of insurances:

Classic American Express (€60 per year):

Travel accident insurance

Baggage insurance

Wallet or purse theft insurance

Purchase Protection

Premium American Express (€120 per year):

Travel accident and inconvenience insurance

Trip cancellation insurance

Extended Baggage insurance

Wallet or purse theft insurance

Purchase Protection

So how much are those miles worth?

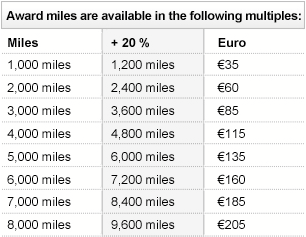

It all depends on what you spend them. In my opinion, only long-haul Business Class and First Class flights are worth spending miles on. These allow you to maximize the value of your miles as Business Class flights easily cost +€2000 and First Class flights +€8000. Of course airline loyalty programs will do everything to make you spend your miles on less valuable options e.g. use miles to buy goodies in their online shop, book hotel nights or rent a car. You really don’t want to do that! Miles and More is currently selling miles with a 20% bonus, which is still way too expensive, but it gives you an idea how they value the miles.

As you notice, 6000 miles are sold for €135. That’s more than the yearly fee of the Brussels Airlines Premium American Express card which comes with 6000 sign-up miles! Same for the sign-up bonus of the Brussels Airlines Classic American Express card, those 3000 miles are sold for €85 (+600 miles bonus).

How do I maximize the number of miles earned?

I would recommend to sign-up for the Brussels Airlines Premium American Express card now to get the 6000 miles. Complete the form to pay your cellphone bill with the card and earn an additional 2000 miles. Next year, you cancel the Premium card and switch to the Classic card. You will earn the sign-up bonus again (this time for the Classic card, which is at least 1500 miles if there’s no promotion) and you’ll earn another 2000 miles when you register to have your cellphone bills paid with the Classic card. That’s at least 11,500 miles in one year, just by signing up for these cards!

I’m not yet a Miles and More member, where do I sign-up?

You can enroll at the Miles and More website.

UPDATE MARCH 2022: Check the new offer with 20,000 bonus miles!

Full disclosure: By signing up for a Brussels Airlines American Express card using a personalised link, I will receive bonus miles (friend referral program). Thank you for supporting my travel blog and enjoy your sign-up bonus.

Hi Bart,

Do you know whether ATM withdrawal with the MasterCard or AMEX card will also earn you miles ?

Thanks in advance !

Cheers,

Philipp

Hi Philipp, ATM withdrawals don’t earn miles. Would be too easy to earn miles. 🙂

True 😉 Thank you for the quick reply!

This is just in:

REFRESHED BRUSSELS AIRLINES CREDIT CARD PRODUCT

Brussels Airlines Premium American Express®:

– 6000 welcome miles instead of 3000 welcome miles for every new account

– Annual fee increases from 120 EUR to 150 EUR for new and existing accounts

Brussels Airlines Classic American Express®:

– This product will be rebranded as Brussels Airlines Preferred American Express®

– € 1 = 2 miles for each euro you spend at Brussels Airlines tickets

– € 1 = 1,25 miles (instead of 1 mile) for each euro you spend elsewhere with your Card

– 3000 welcome miles instead of 1500 welcome miles for every new account

– Annual fee increases from 60 EUR to 120 EUR for new and existing accounts

– Supplementary card fee increases from 20 EUR to 40 EUR

SEE MILES-AND-MORE-CARDS.BE FOR MORE DETAILS. This website replaces spend-and-earn.be

Didn’t receive any info about the MasterCard but I checked on the new website and it seems that the annual fee increases from 60 EUR to 90 EUR and 2000 miles welcome bonus instead of 1000 miles.

Thanks Sebastian. I got a heads-up from Alpha Card yesterday evening. Not happy with these changes, definitely not the fact the fee for existing members will be increased too. You can expect a blogpost soon.

Thanks for the info Bart.

With the Brussels Airlines Classic MasterCard® also being rebranded as “Brussels Airlines MasterCard®”, I really do wonder what will happen to us Brussels Airlines Premium MasterCard® cardholders. Although the product is being phased-out since last year, I still own the card and they still charged me the Premium 90 EUR renewal fee last month.

Got some more insider info that the MasterCard product will also be very soon “refreshed” into a Business and a World variant with the option for Premium cardholders to convert to either card. This is yet unconfirmed, but a quick Google search reveals insurance policies for both cards: http://www.miles-and-more-cards.be/pdfnew/AIG%20BCC%20-%20Miles%20&%20More%20MC%20BUSINESS%20-%20NL%20-%2020140306.pdf and http://www.miles-and-more-cards.be/pdfnew/AIG%20BCC%20-%20Miles%20&%20More%20MC%20WORLD%20-%20NL%20-%2020140306.pdf

Alphacard just confirmed to us that the higher fee only applies to new customers.

Used your invite for the AmEx Premium in jan.’14.

Got 3000 welcome miles.

Called to redeem the 3000 extra bonus miles.

Operator told me, after 10 minutes thinking time or so, he would call me back a couple hours later: never happened.

Called again a week later.

Another operator told, again after gathering her thoughts for 10 min., me she would call back, I refused.

The operator told me, after getting to her supervisor, duh, that after 1 year I would be eligible for the 3000 extra miles.

I refused, said I had the invite mail which clearly stated 3000+3000miles immediately.

She had to meet again with her boss, then told the system had technical difficulties and my extra 3000 miles would be added at the latest end april ’14.

My opinion is they try not to give the extra miles, and when they have to, they want to postpone until it’s clear you are a paying non-dubious customer.

I don’t doubt I will get my extra miles but it shouldn’t work this way 🙂

Joris, this is unacceptable. I’ll forward your input to the Amex customer service manager at Alpha Card. You can expect a reply early next week. Thank you.

Hi BArt. I actually don’t mind a lot. Of course I want these 3000 extra miles. But I want my experience to be available to others, especially people that aren’t that assertive to stand up to a company/customer service that is reluctant in applying their own promo scheme.

But I also want to emphasize I don’t think you are responsible in any way,

On the contrary, thanks to put these actions on your blog.

it is still only for belgium residents or can any EU resident apply for this card? Im based in Germany and Ive heard that due new SEPA regulations from 01.02.2014 would be possible to authorize direct debit from any EU country to another EU country, which means, it would be just a breeze to link the card to my german acc.

If so, im inclined to get the amex premium who offers 1,5 miles for every € spent, this ratio beats my lufthansa credit card hands down.

Does anyone know more about this?

Hi Glarus, only Belgian residents can apply for the Brussels Airlines American Express card. I’ve seen way better sign-up bonuses (up to 30K miles) in Germany, so I would be on the lookout for those offers if living in Germany. Thanks.

Thanks Bart, I am/was more interested in the euro/miles ratio than sign-up bonus. With 1€ = 1,5 miles I could easily generate 125k miles year.

Bedankt voor deze aanbieding. Is het nog geldig aub? Heb de link al 2 keer aangevraagd maar krijg niks in mijn mail (ook niet in spam).

Thx! Gr

Michel, the offer is still valid. I need to create the application link manually, you can expect it tomorrow. Thank you.

Great! Thank you very much!

Just received my premium AMEX card today. To my great surprise, it’s a card WITHOUT A CHIP!!!??? Can you even use these cards in shops these days? Or only for only purchases?

Hi Thomas

Sure, just swipe it through the terminal. On the classic gray Atos Worldline “cube” terminals, you can swipe it through the orifice on the right hand side of the orifice for the chip cards. Just a hint: the magnetic stripe needs to be at the lower left hand side when you swipe it on this terminal :-). On other types of terminals there will also be the possibility to swipe your card.

After you swipe the card, the transaction will (normally) go through and the terminal will print a ticket and will ask you to sign it. This counts as your signature for approval, just like the entry of your pincode. The merchant has to keep this ticket as proof. Many merchants however do not know that they have to ask for your signature and will let you go without signing. According to the AMEX terms and conditions, no signature does not yet mean that you didn’t authorize the sale.

Unfortunately you will not be able to pay at any automated vending stations, like NMBS kiosks or those at gas stations as these require a card with a pincode.

Within a year, your card will be replaced with another card which will have a pin.

Regards

Sebastian

Thanks for providing all the details Sebastian!

Thanks for the clarifications, Sebastian. I’ve had magnetic stripe cards in the past, but that must have been in the Middle Ages. I think most banks started fasing them out somewhere between WWI and WWII. And now, for the first time in my life, I PAY to get a credit card, and I get a completely outdated technology!!??

Bart, got a call from AMEX too, they told me they had corrected the issue and my miles should be in my account after the next billing period. So i’ll see in a couple of weeks if it’s all ok. Thanks for you help.

Good, keep me updated. Thanks!

Hi Bart,

I’m considering changing from my Belfius Mastercard to a CC which could earn me actually some miles.

I do have a Corporate Amex card (which doesn’t cost me anything, but indeed has the weaker conversion rate of 2 Membership Reward Points to 1 M&M point).

I’m still in doubt if I should apply for the M&M Mastercard (which indeed has a smaller welcome gift, and no yearly gift in points) as a replacement of my current Mastercard and stick to my Corporate Amex (which comes without a fee), or if I could apply for both the Mastercard ánd the Amex. I’m not in favor of ditching the Mastercard all together, because I’m not sold on the usability for daily payments with Amex in Belgium.

Hi Dieter, I would suggest to apply for both the M&M MC and Premium Amex (1,5 miles per € + 6000 welcome miles) Thanks.

Bart,

just been called by AE.

They have added the missing 3000 bonus points. so nexth motnh they should be in my M&M account!

They are calling all the persons you referred to with the sign up link so I guess it will soon be ok for everyone.

Thanks for your feedback Geert. I’ll follow-up closely with the other folks too. Let me know if any other issues arise the future. Thanks.

Pingback: Tomorrowland 2014 - Hoe je wel tickets had kunnen kopen - Dailybits weblog

Bart,

Thx for the followup!

Bart, thanks for the quick reply. Good to hear you are trying to help – mind you, I wasn’t blaming you for the errors made by Alpha Card or by M&M. Now if you get us all some extra bonus miles as an apology from Alpha Card, I would become an even bigger fan of you 😉

Same here, altough I did give my M&M account number(created one a few days before applying) when applying for the card. A few days later I received my M&M member card. A week or so later I recieved a second member card with a different number. so contacted Miles and More and 2nd account semed to be created by AMEX. Anyway, they merged the 2 cards immediately so I have now 1 member card. But then again, I also did not receive the extra 3000 miles referral bonus. (only the first 3000). So I called AMEX(paying number). Explained situation to operator. She said there was no such promotion for 6000 bonus miles. I said I would be happy to send an email clearly stating the promotion. She answered it was impossible to communicate through email. I couldn’t believe my ears!(no communication via email in the year 2014) Anyway she refused the extra 3000 bonus miles. At that point I was so fed up with AMEX I asked how I could cancel my AMEX. Then suddenly I got another person on the phone where I explained again the situation. He said I would be granted the extra 3000 miles if I would spend another 500 euro’s with the AMEX in the next 3 months. Since that would be no problem for me(I pay my NMBS card with it) I agreed(altough I should have been given the 3000 without any condition). Will see if they will add my extra 3000 points in 2 months. Bart contacted me about this but I think he also got no reply on this matter.

Hi Geert, I’m still discussing this matter with Alpha Card. Unfortunately, their support model is bureaucratic which results in slow responses. You’ll be contacted soon (fingers crossed). Thank you for your patience.

Bart, I’ve got the AE card through a link of yours. I’m still convinced it is a useful way to gather miles, but I had hoped it would require a bit less work from the card owner to actually get their miles… It seems the link between AE and M&M is difficult in case you don’t have an M&M account to start with. So a tip: if you don’t have an M&M account yet, just create one yourself first, then pass that info in your AE subscription info…

Here’s my complete rant:

http://www.flyertalk.com/forum/lufthansa-austrian-swiss-brussels-lot-other-partners-miles-more/1547528-brussels-airlines-american-express-card-m-m-rant.html

Same thoughts exactly, after two months of nagging, emails and phone calls I still haven’t received the extra 3000 miles from your referral. Miles and more program sends to work fine but alphacard doesn’t.

Yoni, glad to hear I’m not alone. I don’t really agree with your statement that the M&M program seems to work fine, though… I hope I find the energy to write my next rant about that tomorrow, but in short: after 5 months of membership I’m missing miles for three flight legs, one car rental and two hotel stays…

Dear Win, thank you for your feedback. I agree the communications and services provided by American Express Belgium for the Brussels Airlines cards (run by Alpha Card NV) has been seriously lacking in the past year or so. I have a long list of complaints from several people who requested their Brussels Airlines Amex card via my referral link. I’ve been in touch with Alpha Card several times, but unfortunately didn’t receive a satisfying answer yet. I’m no longer going to accept this and will soon communicate a final deadline to Alpha Card. If no solution is provided, I will escalate this higher up in the chain. Unfortunately, we don’t have any alternatives in Belgium to collect miles with credit cards. (the Brussels Airlines MasterCard is also run by Alpha Card) Thank you for your patience.

Bart, do you think there is a possibility that SN will launch another promo for the Amex card soon? Still need to order one but want to wait for the right moment..

Hi Oscart, the only promotion I’m aware of which is currently active is the double welcome miles. Submit the form above to receive a referral link. Thank you.

For those not using a company fuel card, you can now use your AMEX at most of the Gabriels unmanned fuel pumps. It’s not always on the displays, but just try it.

Great, thanks for your input Simon!

Pingback: Credit cards en loyalty programs

Mediamarkt Belgium apparently does not accept AE anymore since 2014

Thanks for the input Geert. Same for the Coolblue online shops. Will ask my AlphaCard contact why these shops suddenly abandon Amex. (I guess the high fees)

I also can’t pay with my amex at the nmbs any longer… Soon no possibilities left.

Hi Yoni. Thanks for your input. At least we can still pay our groceries at Delhaize with the Amex card!

Not sure which train station you’re talking about, but as of today I’m still able to buy train tix with AMEX (AX) both on the train and at the ticket desks in the train stations, and also online on their website.

I asked the lady at the ticket desk and she said that she didn’t hear any instructions or rumors about AX disappearing anytime soon.

Please note that lack of the AX sticker on the terminal doesn’t necessarily indicate that AX is not accepted. Always try using your AX card. If the terminal doesn’t accept, it will say “NO LABEL” or similar.

But yes, Bart, if you could please inquire Alpha Card about the high amount of merchants that abandoned AX during the first month of this year. It certainly doesn’t make their card members very happy.

Yes I love my Amex and using it for travel, but I see no reason why they charge higher fees to merchants?

Pingback: Brussels Airlines: B.Gift Christmas Offer | travel.bart.la

Pingback: Thai Airways: A380 Royal First (Bangkok to Tokyo) | travel.bart.la

Another trick I found with this card is that if you find online shops that don’t accept Amex, but do accept Paypal, link your Amex card to your Paypal and therefore get the spendings on your Amex anyway.

Hi Animine, that’s a great trick! I’ve used it in the past too, works!

Works great, received Amex card today 🙂 How long would it take for the sign up bonus miles to get into the Miles & More account?

Hi Animine, it might take up to 2 months for the bonus to post since it’s a manual action to post them to your M&M account. Thank you.

Points are already in my account today 😀 I guess any spendings on the Amex card get transferred into the M&M account after your receive/pay the monthly bill?

Correct. Miles post on your M&M account the day after the online statement has switched to next months billing cycle. Thanks.

I did receive the 3000 welcome miles for my amex, but they still haven’t added the 3000 extra I should receive from your referral…

Yoni, thanks for the heads up. I’ve just emailed Alphacard (manages Amex in Belgium) to verify this for you. I’ll update you when I get feedback. Thank you.

Still no change, btw I never received any communication about the 120 euro promotion they did in november; you could book a flight with Brussels Airlines for 120 euro if you took the platinum card. Tried several times but saw no clues or help anywhere. Any idea Bart?

Yoni, you couldn’t combine both promos. It was 6000 welcome miles or €120 discount on SN flight. I’m still waiting for feedback from AlphaCard for your case. Thank you.

Bart,

Is the dubbel signup bonus still availlable? I have send a request.

Thx

Hi Michel, yes it is. You’ll receive the personalised link tonight. Thank you!

Hi Bart, I just found this blog on pinterest: http://travelpaintrepeat.com/post/59743516609/how-i-afford-travel and Megan uses 2 credit cards: 1 British airways Amex (useful because part of one world alliance, which means u can use ur miles at other airlines) and an other amex.

Is this a good idea? or is this not usefull for belgium?

Lieve, unfortunately those cards are not available for Belgian residents.

Pingback: Lufthansa Miles & More: Earning miles | travel.bart.la

Completed the referral form more than a week ago, still nothing from Amex. Will have to do it again, i guess?

Thomas, did you get my initial referral email?

No, checked my spam folder too, nothing there either

Thomas, will send you the referral link once more later today. Thank you.

I filled in the form for the double welcome bonus.

When will I receive the sign-up link

You’ll receive it within 24h. Thank you.

Bart, one more question: if you have several Belgian bank accounts, is it an idea to get an BA Amex card for all of these accounts, but only use one for your purchases? And then stop all the others after one year? Or is your Amex card linked to your name and not a specific bank account?

Thomas, cards are not linked to bank accounts, rather to your name. You cannot request multiple Amex cards of the same type. However, you can request an Amex and a Mastercard.

Or one for me, one for my wife and one for my business?

The sign-up bonus miles for your wife’s card will end-up in her Miles&More account, not yours. (You could give it a try, but normally the card holders name and the M&M account name need to match) As far as I’m aware you cannot link a Brussels Airlines M&M Amex to a business. You’ll need to request a Business Amex for that. In that case you can use the Membership Rewards program.

but I can be the friend referral for her 😉 and you’ll get my referral points (just checking a last few things). Is the double points promotion still valid?

Yes, double welcome miles via referral is still active.

One more question: how good is this travel insurance? Does it cover the whole family? Can it replace any current dedicated travel insurance you would have (i have Europassistance yearly travel insurance)?

Thomas, see the links below for the details on the included insurances

Brussels Airlines Premium American Express: https://www.americanexpress.be/sites/default/files/pdf/aig_amex_mmpremium_tc_full_nl.pdf

Brussels Airlines Classic American Express: https://www.americanexpress.be/sites/default/files/pdf/aig_amex_mmclassic_tc_full_nl.pdf

Do you need to top up your balance each month manually, or can you have an automatic payment from your bank account, so you never pay the hefty interest?

Thomas, yes you can select automatic monthly payments to avoid any additional charges.

@ Bart, ik wil al een tijdje airmiles gebruiken omdat (buitenlandse) vrienden hier toch vaak voordeel uit halen en regelmatig goedkoper kunnen vliegen.

Als ik het goed begrijp, kunnen wij in België enkel het ‘Miles & More’ programma van Lufthansa gebruiken… Als ik het goed heb, kun je miles verzamelen door ofwel allerlei aankopen te verrichten met je (krediet)kaart, ofwel te vliegen met een maatschappij binnen de StarAlliance-groep.

Dus als ik nu bijvoorbeeld met RyanAir (valt niet onder StarAlliance) naar Barcelona wil vliegen, geldt enkel het bedrag dat ik met mijn kaart heb betaald (bvb. 100euro voor de vlucht en krijg ik dan 150miles voor) maar krijg ik geen miles voor die vlucht omdat ik niet met bvb. Brussels Airlines vlieg.

Indien ik nu eens naar de de mile-deals ga kijken, zie ik dat ik voor 12 000 miles naar Barcelona kan vliegen. (http://www.meilenschnaeppchen.com/index.php?lang=en) Dit vind ik enorm veel miles voor zo een korte vlucht… Ik zie dan ook niet meteen het voordeel van miles sparen (aangezien een kaart ook jaarlijks geld kost). Kan jij me hier meer over vertellen?

Verder valt het mij ook op dat als ik miles wil kopen, dat ik €245 betaal om 12 000 miles te bekomen. (http://www.miles-and-more.com/online/portal/mam/de/account/public_information?nodeid=2567997&l=en&cid=18002)

In andere woorden: ik betaal €245 om mijn vlucht naar Barcelona (12 000 miles) te betalen. Lijkt me dan erg onredelijk als andere maatschappijen vluchten aanbieden voor circa €50 naar Barcelona, niet?

Koen, in most cases it doesn’t make sense to spend your miles on Economy class tickets. Don’t forget, with Miles & More you still need to pay Taxes & Fees (fuel surcharges!) on top of the miles you use. So in general you can assume it only makes sense to save miles to use on Business Class and First Class award tickets. We’ll have a specific session on the Lufhansa Miles & More program at TravelMagic 2013. Feel free to sign-up and join us on Sep 21, 2013 at The Hotel, Brussels. Check http://www.travelmagic.be Thanks.

@Bart, bedankt voor de info! Weet u of het mogelijk zou zijn om de de Amex kredietkaart op een firma in te schrijven en de punten te laten overvloeien naar een miles and more kaart met andere naam (natuurlijke persoon), die totaal niets met de firma te maken heeft?

Tomas, dit is spijtig genoeg niet mogelijk. Je kan wel een American Express Corporate or Business kaart aanvragen en punten sparen met het Membership Rewards programma. Maar voor Belgie zijn de conversie rates naar Miles and More niet interessant. Je krijgt 1 Membership Rewards punt per euro, maar je hebt twee punten nodig om 1 Miles & More mijl te krijgen. Meer info op http://www.americanexpress.be/nl/particulieren/membership-rewards

Bart, ik ben ook aan het overwegen om een kredietkaart aan te schaffen. Maar ik zou eerder opteren voor de “Mastercard” je verdient wel minder mijlen per euro aankoop maar ik vermoed dat je met deze kaart meer betaalmogelijkheden hebt dan bij de “Amex”. Wat denkt u?

Ik vroeg me dan ook nog af of er intresten zijn (buiten de jaarlijkse bijdrage) op de bedragen die betaald worden met de kredietkaart.

Tomas, er zijn geen kosten verbonden aan het betalen met Amex zolang je in € betaald. Je moet gewoon op het einde van de maand betalen wat je in de afgelopen 30 dagen hebt uitgegeven. Met Mastercard kan je inderdaad op meer plaatsen betalen, maar ik zou je aanraden om minstens twee credit cards te nemen. Altijd handig om eentje als backup te hebben. Volgens mij is de beste combinatie de Brussels Airlines Premium American Express kaart om euro betalingen te doen en mijlen te sparen. Als tweede kaart raad ik de BKCP Visa kaart aan, hiermee spaar je geen mijlen, maar er zijn geen kosten bij het betalen in niet euro landen. Je kan deze Visa dan ook gebruiken als men Amex niet aanvaard. Meer info hier https://travel.bart.la/2013/02/04/credit-cards-for-belgian-travellers-in-depth-review/

Pingback: Een weekend travelmagic naar Birmingham door Sven Luckermans - Dailybits.be weblog

I just found this:

https://www.beobank.be/nl/promoties/kredietkaarten/beo-travel-pass-world-mastercard.aspx?utm_source=AFF_YD&utm_medium=RON_728x90_NL_Travel_Pass&utm_campaign=Cards03

Seems that Belgian Banks are slowly starting to use the Mile System

But miles have a shelf life of only 3 years….

Beobank is the new name for Citibank Belgium. They offer horrible rip-off deals (insane interest rates, etc…), including this card. The so called ‘miles’ are fake and cannot be used with a specific airline or alliance.

Good to know!

This is not true, I flew with my 80.000 miles saved to Bangkok just paying the taxes on the thai airways flight (star alliance) all this with my beobank travel pass master card

Hi Lesire,

Thank you for your input. How much were the taxes & fees, was it Thai Economy class? How much did you have to spend to earn those 80K miles? Thanks.

Hi Bart, I applied for the master card travel pass when it was still citibank, i immediately recieved 10000 miles i became godfather of my friend who also asked the card and earned another 5000 miles, with 15.000 miles you fly economy in west europe (ex. In july and august) also here you pay only the taxes and you choose from which airport (incl. Cologne, dusseldorf and amsterdam) you want to leave and with the company of your choice. For my trip it took me some time to save the 80.000 miles, i think i spend about 65.000 eur. But i use my card for all my shopping including telephone, gaz and electric invoices. I called the travelcenter booked my trip to BKK and payed 236 eur taxes. I travelled in economy. The first year the card is free.

There is also a good insurance on the card, in case of delay you can spend up to 250 eur.

Lesire,

Thank you for sharing the details. Spending those 65K euro with the Brussels Airlines Premium American Express card would have earned you 135,500 miles (1,5 miles per euro + signup bonus of 6000 miles + 10000 miles bonus per year for spending 20K euro + 2000 miles for paying your cellphone bill with the card) This would have been enough for a round trip ticket in Business Class (135K) to Bangkok. You could have even flow First Class to the Middle East roundtrip or one-way First Class to Bangkok for 105,000 miles. The value of your economy class ticket was ~600€, minus the taxes leaves you with a reward of 400€ for spending 65K euro…

Perhaps but the american express card is not accepted in the shops i frequently visit nor on eni.

That might be correct, Amex is not as widely accepted as Visa. Still, you might consider spending euros on Amex were possible to earn more M&M miles.

I’m planning on changing my MasterCard Red by Belfius to one of the Brussel Airlines cards to start saving on miles. The Platinum AmEx card looks pretty good (the €120 fee is what I would spend on traveller’s insurance each year anyway), but are the places to pay with AmEx in real life in Belgium worth it? I’ve read the comments above, but I’m still not convinced. What I’m trying to figure out is: would I be able to pay for more stuff with MasterCard to compensate for the extra half mile per euro spent that I could get with the AmEx Card?

PS: I’m a noob at this so any and all comments are appreciated!

Sandr, you might want to keep both cards. It’s always good to have a backup card in case the other one gets declined (payment authorization failure etc…)

Pingback: Credit Cards for Belgian Travellers: In-Depth Review | travel.bart.la

The T&C of the Amex International Euro Card which I mentioned above, say: “Unless a specific rate is required by applicable law, you understand and agree that the American Express treasury system will use conversion rates based on interbank rates that it selects from customary industry sources in effect or applicable on the business day prior to the processing date (called reference exchange rate), increased once by […] 2.7% for Euro cards […] or as otherwise disclosed by us.”

The advantage of these international Amex cards is that you can also apply for an International Dollar Card, which you will have to pay from a USD account with your bank. This is a perfect way to avoid incurring these charges.

If interested, I have a referral form that gets you 50% off the first year’s fee as well as up to 15.000 membership rewards.

You mean the Dollar card is great when you actually want to pay dollars (in the US). The conversion rate on the 3 cards (dollar, euro and pound) is quite hefty.

Click to access terms_conditions.pdf

3% for USD. 2.7% for euro. 2.99% for pound card.

@Stefanvds Thanks again for all the useful input! About the BKCP card, Spaargids says it comes with a €1500 standard limit and NO fee for cash withdrawals in the eurozone. That sounds quite remarkable, because this would allow you to ‘borrow’ money for free for 30 days. At the start of the cycle you could withdraw €1500 from the cash machine without any fee and you only need to pay it back at the end of the 30 day cycle… must be some hidden fee somewhere, not? I also wonder what requirements there are to get the card approved. Just open an account at BKCP and prove you have a regular income or do you also need to have your wages transferred to that account each month? Thanks.

I will keep you posted on this. I can’t answer it yet, but in my experience the smaller banks are always able to get you better deals than the big and famous banks. There is an annual fee of 20eur… So it’s never really free but it’s very cheap indeed.

I’ve got confirmation that withdrawing money out of the EU costs 5EUR with the BKCP VISA and maestro card. In the EU, no fee, and the conversion is indeed 0% commission. Looks like you just need to open an account to get the card.

Thanks for the update Stefan! The only thing left to verify is the exchange rate. We should try to make a payment with two (or more) cards (incl. the BKCP VISA) in a non-Euro country at the same day and then compare the exchange rates. Just to make sure BKCP exchange rates are OK. Thanks.

“I also wonder what requirements there are to get the card approved. Just open an account at BKCP and prove you have a regular income or do you also need to have your wages transferred to that account each month? Thanks.” I ask myself the same questions. Could you provide me with the answer?

I can only say: It depends. Just make an appointment with a local BKCP office. They asked me to have my pay check paid out to their account. Bart got the card with a little less trouble. Depends a lot on the person I reckon 🙂

@Stefanvds Excellent input Stefan! It’s indeed very important to keep in mind there’s a hefty conversion fee (2,5%) for non-euro payments with Brussels Airlines American Express cards! Unfortunately there’s no card available in Belgium which earns miles or points without a conversion fee (that I’m aware of).

A few open questions for which I couldn’t find the answer yet:

– Do I read ‘Spaargids’ correctly? The OBK Bank Visa Classic and BKCP Bank Visa Classic look like the best choices for making payments in non-euro currencies and to withdraw money from ATM machines (cash advance) outside the euro-zone.

– On top of the conversion fee, all credit card suppliers use an exchange rate to convert foreign currencies to euro. How ‘free’ are credit card suppliers in determining the exchange rate? Are the obliged to use the fixed market rate? e.g. Would there be a difference in exchange rate if I would make a foreign currency payment with my visa, amex, mastercard at the exact same time. If there would be a difference, it would be hard to determine which is the better card (the one which offers the best exchange rates)

– Is the conversion rate for the Brussels Airlines MasterCards also 2,5%? I couldn’t find it in the T&C, I only read the cash money withdrawal fees are the same (1% at ATM with min. of €5) And what about the non-Brussels Airlines branded American Express cards, do they all have a 2,5% conversion fee? Or is the conversion fee variable depending on which type of AMEX card you use?

I think you’ll have to look at each AMEX card separately. Clearly for Mastercard and VISA there is no golden rule of the conversion fee. For AMEX I sense there might be. The Brussels Airlines T&C says that 1% of the 2.5% is for AMEX itself. So we can state 1% is a minimum.

Anyway about OBK bank and BKCP. I contacted OBK recently and they are being bought by BKCP so they’re merging.

The T&C always say that the exchange rate *might not be* the exchange rate on the day of payment, but it will be the exchange rate on the day the payment is requested on the card (can be a few days later sometimes). I don’t think they can fool around with those rates. That would/should be illegal.

I think it would be good to contact Brussels airlines about the mastercard because it indeed does not specify the conversion fee in their T&C.

You did read spaargids correctly. OBK and BKCP are THE cards to have to withdraw money or pay in non-euro currencies. Both of them have a lot of small, privately owned branches so I reckon the service of them should be pretty good.

Myself I am using a Belfius Mastercard now (5EUR for withdraw, 1% fee on conversion) which is OK, but I want to do better. I’m going for a BKCP card. I’ll keep you updated.

The conversion rate for brussels airlines masterCards are 0%!

Have you ever looked at the conversion fee you pay on credit cards? The American Express card seems a rip-off in that sense. In the TOC (http://www.spendandearn.be/pdf/voorwaarden_americanexpress.pdf) point 3.4 (no english available) you are charged 2.5% of the sum for any payment that is not in Euro’s (or USD?). When traveling around the world, those 2.5% can rank up to quite a lot of money.

If you want to get some cash, you pay an extra 1% with a minimum of 5euro. (http://www.spendandearn.be/pdf/pre-contractuele-voorwaarden-americanexpress.pdf)

Paying euro’s with this card is fine. Going out of the EU seems a bad idea.

Personally I’ve been searching a credit card with a 0% conversion fee. I’ve found 2:

http://www.spaargids.be/sparen/mastercard-vergelijken.html?filter_ordernow=0&filter_visa=0&filter_mastercard=0&filter_kostjaarlijks=0&filter_gespreidbetalen=0&filter_prepaid=0&filter_accountobligation=0&filter_verzekeringen=0&filter_bonus=0&filterbank=0&option=com_creditcards&limitstart=0&filter_order=wisselkoerscommissie_noneuro&filter_order_Dir=asc&stab=0&view=cards&task=&Itemid=135

These will charge you 5eur and 0% when you draw cash abroad, and 0% on all non-EURO payments. I think as a traveler it’s something worth considering. On a 800EUR flight, the 2.5% most credit cards have already set you back 20EUR…

Update: Blog reader Simon informed me it’s possible to pay Nuon.be invoices (Electricity and Gas provider in Belgium) with American Express!

Pingback: Loyalty Programs: Account Statuses (July 2012) | travel.bart.la

Hi Bart, is this bonus offer still valid?

Elke, yes it is! Thank you.

@Bart No, I’m not talking about the Belgian American Express. I agree that card really sucks. I’m talking about a little known American Express card that is also available to us Belgians. I’ve written a blog post about it here: http://www.openjaw.be/post/26139155764/the-best-travel-credit-card-youve-never-heard-of

But here in Europe hardly anyone accepts Amex… Have thought about getting one, but as nobody accepts Amex, I don’t see the point…

Simon, you would be surprised how many businesses and retailers accept Amex in Belgium. Most if your online payments can be done using Amex. Offline you can pay your grocery shopping at Delhaize and Carrefour with Amex, you can pay your cellphone bill with Amex, restaurants and many clothing shops accept Amex too. And of course when you travel, you pay all your expenses with American Express too. All depends on what you spend your money of course. Too bad we can’t pay our Belgian taxes with Amex, then at least we would get something useful in return! 😉

@Tom Schouteden Thanks for your feedback. Are you sure you’re talking about the Belgian American Express Membership Rewards program? I know the US Amex program has some great options, but the Belgian website looks hopelessly outdated (https://global.americanexpress.com/myca/intl/catalog/emea/action?request_type=un_intlCatalog&action=CatalogHomePage&Face=nl_BE) and the redemption options for airlines are very limited (only 1 Star Alliance Airline – SAS) and have a bad conversion rate: 1 euro spent, earns 1 membership rewards point, but does not convert into 1 mile, you need 3 points for 2 miles, some airlines even require 2 points for 1 mile! http://i46.tinypic.com/25jlan9.png

On top the Amex Platinum card has a €570 yearly fee!

The Brussels Airlines Premium Amex card earns 1,5 mile per euro spent and has a €120 yearly fee.

You can compare both cards here (in Dutch) https://www.americanexpress.be/nl/particulieren/american-express-de-kaarten-vergelijken/resultaat?cards=70-73

Bart, did you ever consider getting a Platinum Card? Comes with a ton of additional perks (gold status at some hotel chains, lounge access, concierge service, insurance, …) + your points never expire and you can transfer them to an airline program whenever you feel like it (often with a bonus).

@Thomas Dat zou geen probleem mogen zijn. Komt het kaartje uit een folder of magazine? Je kan ook altijd online een Miles and More account aanmaken via http://www.miles-and-more.com/online/portal/mam/be/account/registration?nodeid=2218863&l=en&cid=1000188

Succes en veel plezier bij het verzamelen en spenderen van je mijlen!

Kan je miles verdienen met die credit cards als je momenteel nog maar een voorlopig miles & more nummer hebt (papieren kaartje, wegens nog geen vlucht gedaan)? Of wacht je beter tot je een definitief nummer hebt? Ik vind het nergens terug en een e-mail naar de klantendienst wordt niet beantwoord…